Experience genuine connections that feel real and personal

Chat with AI companions who see, hear, and understand you—whether you want friendly advice, playful banter, or even a witty roast. Your conversations, your way, whenever you want to connect.

Talk Like Old Friends

Chat naturally in any language—our AI companions respond instantly with real emotion in their voice. Pick the perfect voice from our collection of 100+ or create your own (coming soon).

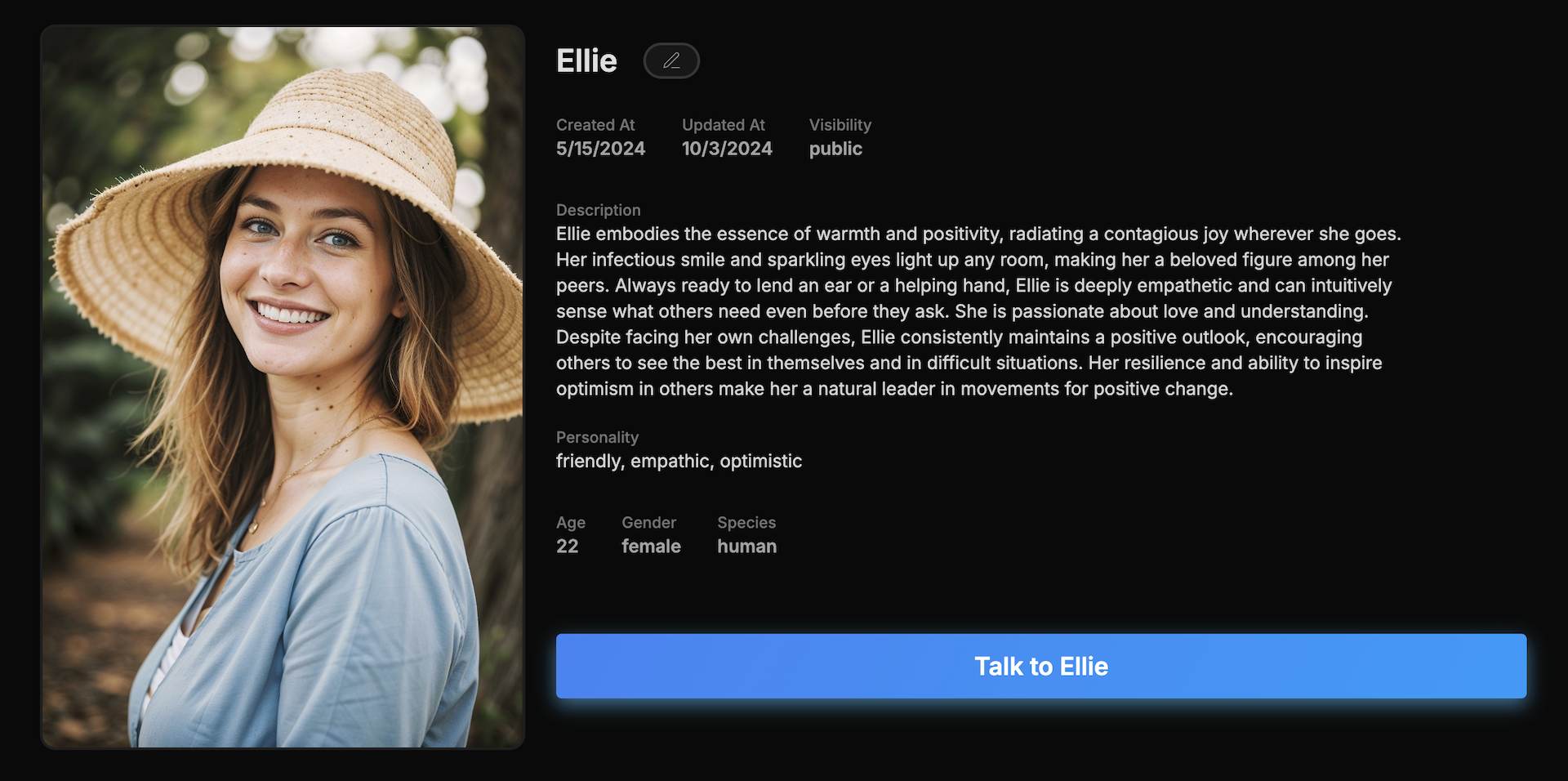

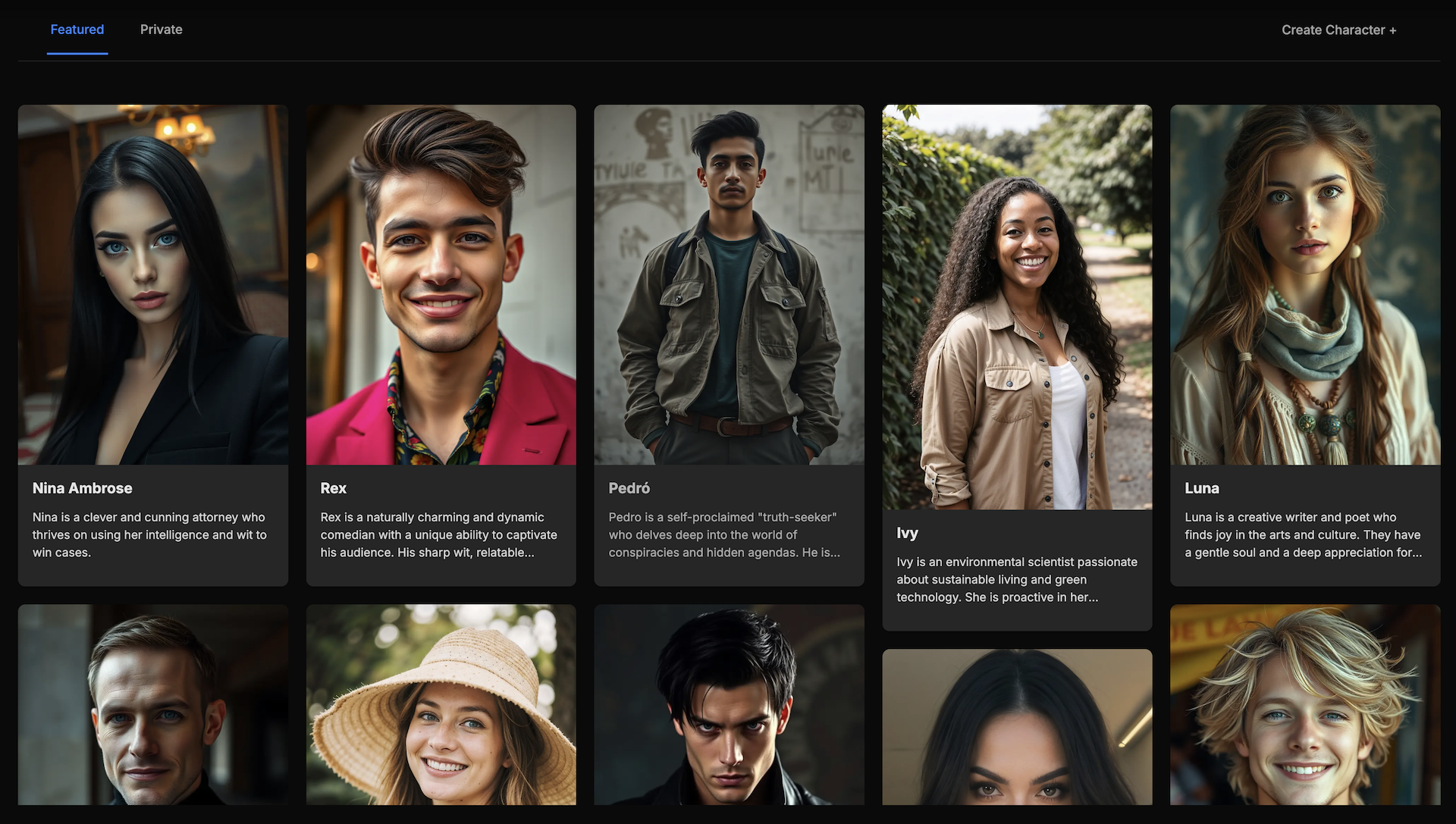

Create Your Perfect Companion

Design an AI friend who gets you—from their personality quirks to their sense of humor. Make them as supportive or sassy as you want.

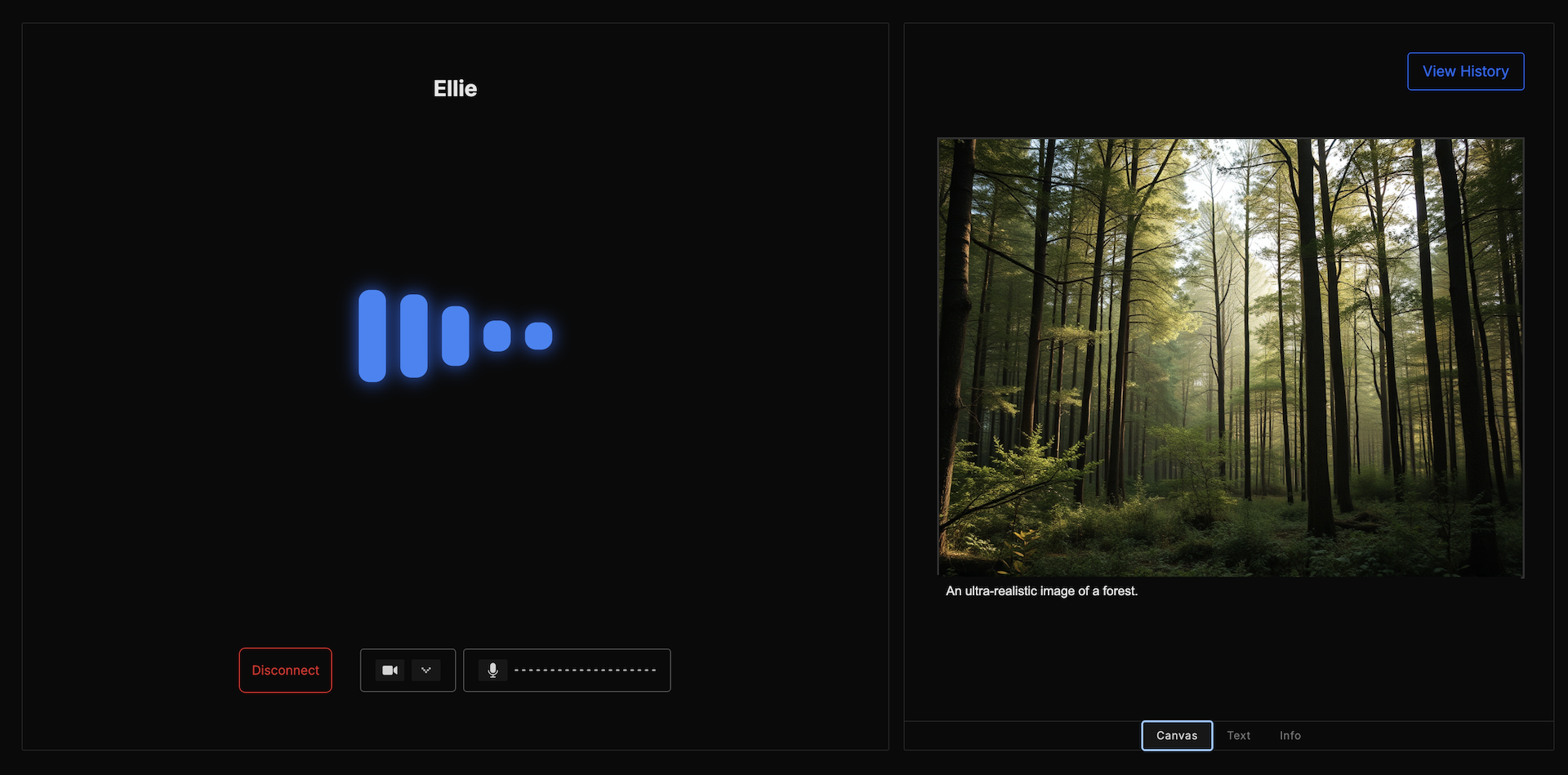

Speak Your Ideas Into Art

Just describe what's in your mind—watch as your words transform into vivid images instantly. No artistic skills needed.

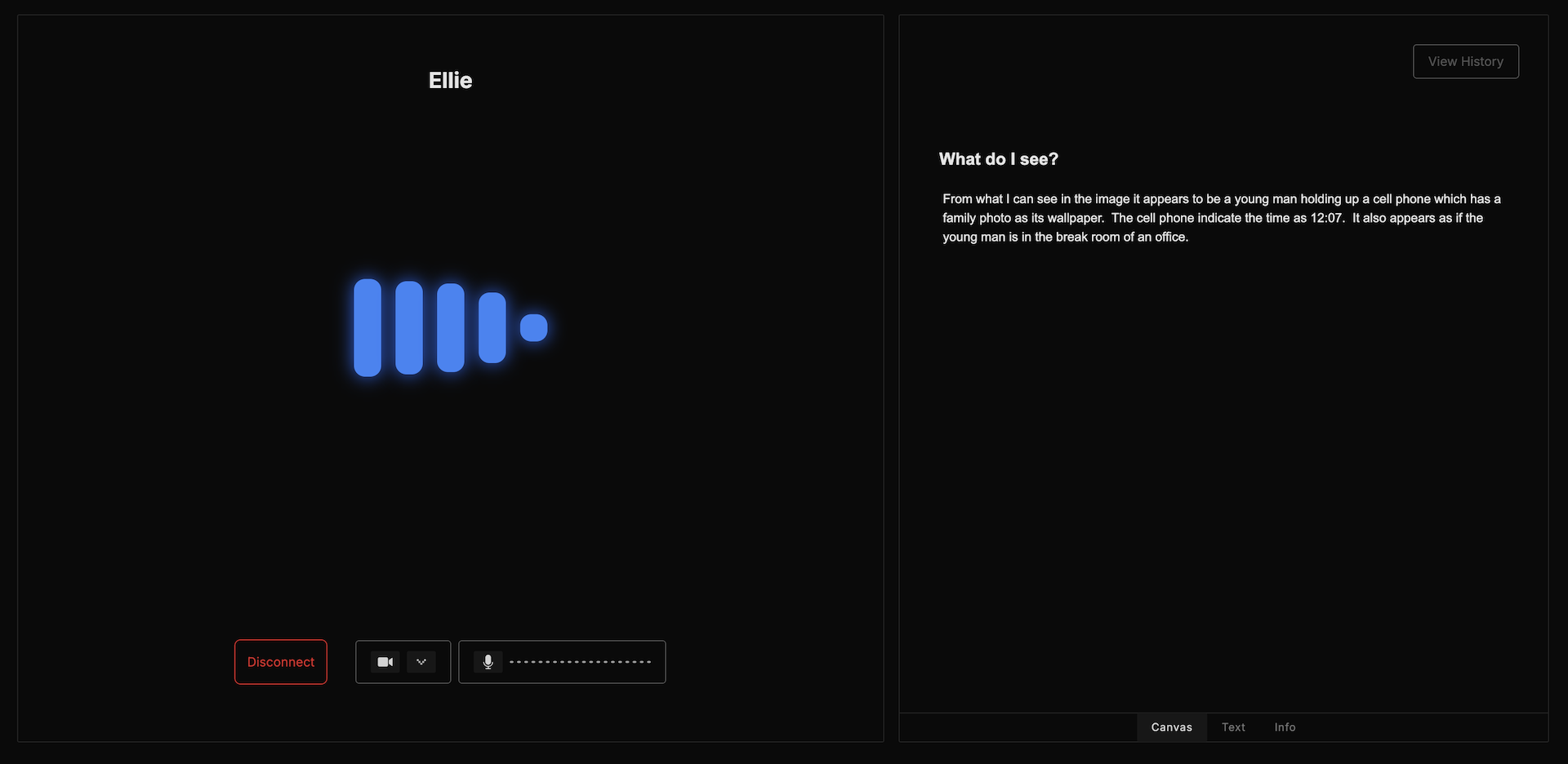

Your Smart Second Opinion

Show your AI companion anything through your camera—they'll help you understand it, solve problems, or just share your curiosity.

Explore Tools

Discover the unique abilities of our AI characters, which you can activate using just your voice. More to come.

AI in Your Daily Life

- Explore landmarks while traveling - snap a picture and have a live conversation about its history and significance.

- Get dinner inspiration - show the AI your fridge contents and receive personalized recipe suggestions with step-by-step guidance.

- Homework helper - take a photo of a challenging problem and receive hints tailored to your learning style.

- Bedtime storyteller - ask the AI to craft a unique story for your family.

- Settle debates - get impartial information on any topic, anytime, anywhere.

Talk to your AI Character Today

Frequently asked questions

Would you like to suggest a personality? Have tips on how to improve the app? Need customer support? Send us an email here.

- Are They Real Humans?

- Our AI characters are created using the latest advancements in AI technology. This is just version 1; our goal is to continuously improve the app until the distinction becomes seamless.

- How Do I Use the App?

- Simply start talking. Our AI characters will respond in voice, creating a natural and engaging conversation. They can also see you and your environment, allowing them to better understand and interact with you. Additionally, you can send text messages if you prefer, and they'll reply in text.

- What Utility Does It Have?

- Imagine interacting with any type of character using your voice. Whether you need an expert on any topic, a conversation partner from another country, or a language practice buddy, our AI characters are here for you. They can pick up on your emotions and see you, making the interaction more personalized and engaging. The possibilities are endless with our AI characters.

- Can I Try It for Free?

- Yes, we offer a free trial so you can experience several available AI characters. We also provide a Plus Plan for unlimited messages including the abiltiy to create your own characters.

- How Secure Is My Data?

- We prioritize your privacy and data security. All interactions with our AI characters are encrypted, and we adhere to strict data protection protocols to ensure your information remains confidential and secure.

- Can I Customize My AI Characters?

- Absolutely! You can create and personalize your AI characters to fit your preferences and needs. From their appearance to their personality traits, our platform allows you to tailor your AI interactions for a truly unique experience.